How to Sell a Home With an Assumable Mortgage

(Step-by-Step)

6. Close Clean, Transfer Title, Walk Away Happy

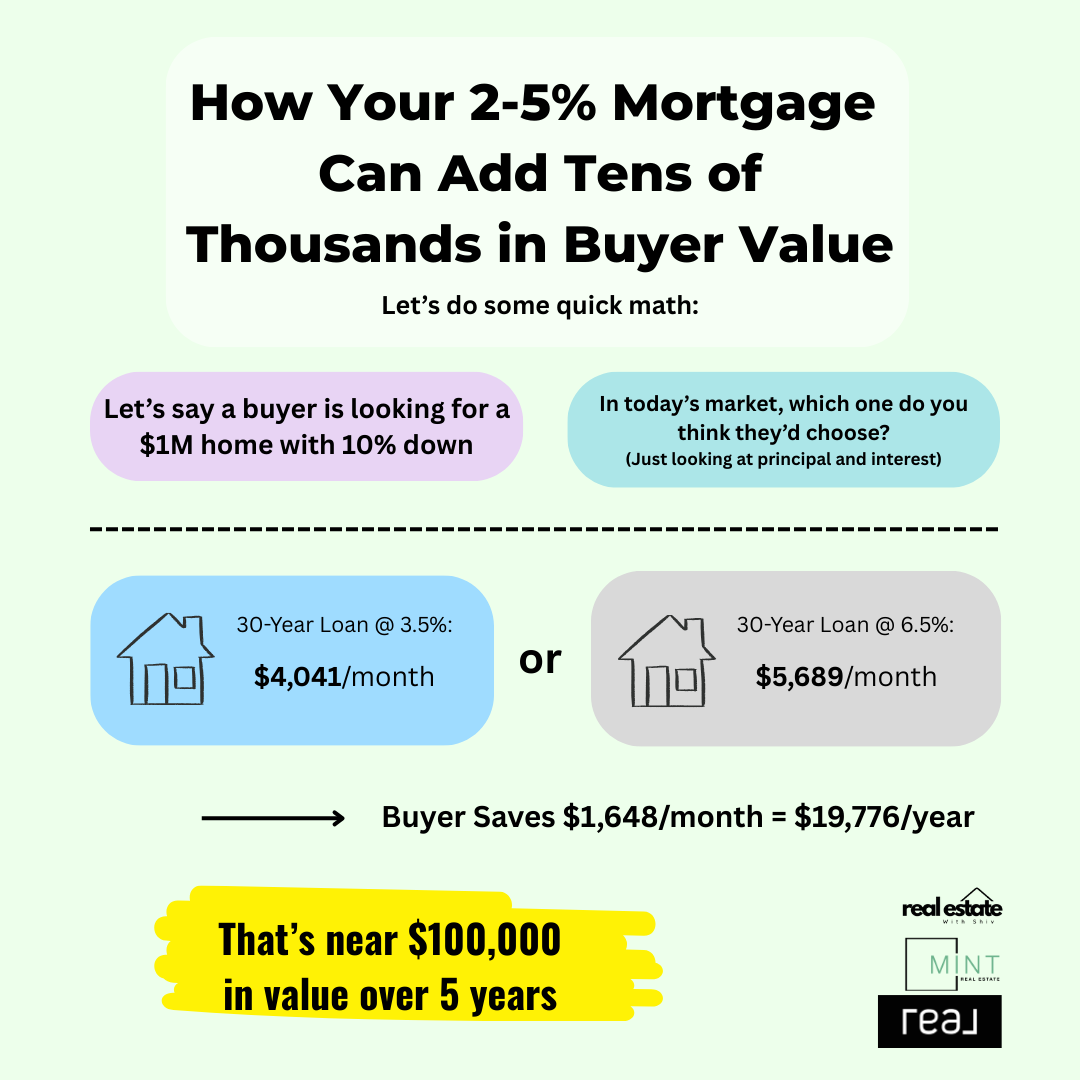

How Your 2–5% Mortgage Can Add Tens of Thousands in Buyer Value

Let’s do some quick math:

Say a buyer is looking for a $1,000,000 home in SoCal with 10% down.

(In about 5 years, the seller would've paid close to 10% of their home's equity using this example.)

🏡 30-Year Loan @ 6.5%: $5,689/month

👉 Buyer saves $1,648/month = $19,776/year

🧠 FAQ: What Sellers Ask Me First

How do I know if my loan is assumable?

FHA and VA loans are typically assumable, and I can confirm that quickly. Even with conventional loans, I can guide you through negotiating with your lender to see if they’ll allow a buyer to assume your mortgage. Either way, I’ll help you get clear answers and create a plan.

Why would a buyer want to assume my mortgage?

Will I still be responsible for the loan after the buyer assumes it?

What does the process look like for me as the seller?

Does it cost anything to sell with an assumable mortgage?

Can I get top dollar if I sell with an assumable loan?

Ready to Sell Smarter?

I help Southern California sellers turn their assumable loan into a competitive advantage.

Whether you’re upgrading, downsizing, or moving out of state, I’ll guide you through the process step-by-step, and make sure it’s legal, clean, and fast.

👉 Book a Free 15-Min Call

Let’s see if your loan qualifies and what kind of buyer it can attract.

Check If Your Loan Is Assumable

Agent | License ID: 02241956